Westhaven Gold Corp.

1056 - 409 Granville Street

Vancouver, B.C. Canada V6C 1T2

info@westhavengold.com

South Zone Preliminary Economic Assessment

South Zone Preliminary Economic Assessment (51.2 MB)

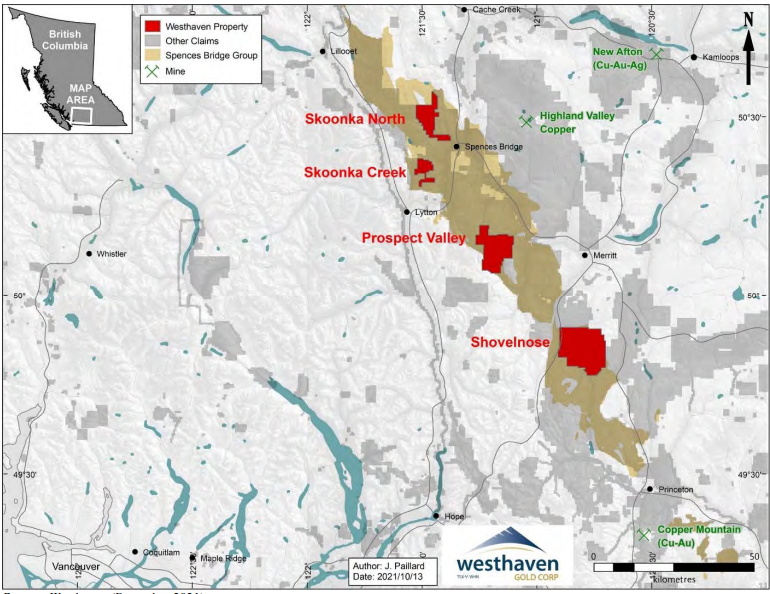

Vancouver, B.C. – July 18th, 2023 – Westhaven Gold Corp. (TSX-V:WHN) is pleased to report the completion of a Preliminary Economic Assessment (“PEA”) at its 100% owned 17,623-hectare Shovelnose Gold Property *the “Property”). Shovelnose is located within the prospective Spences Bridge Gold Belt (“SBGB”), which borders the Coquihalla Highway 30 kilometres south of Merritt, British Columbia.

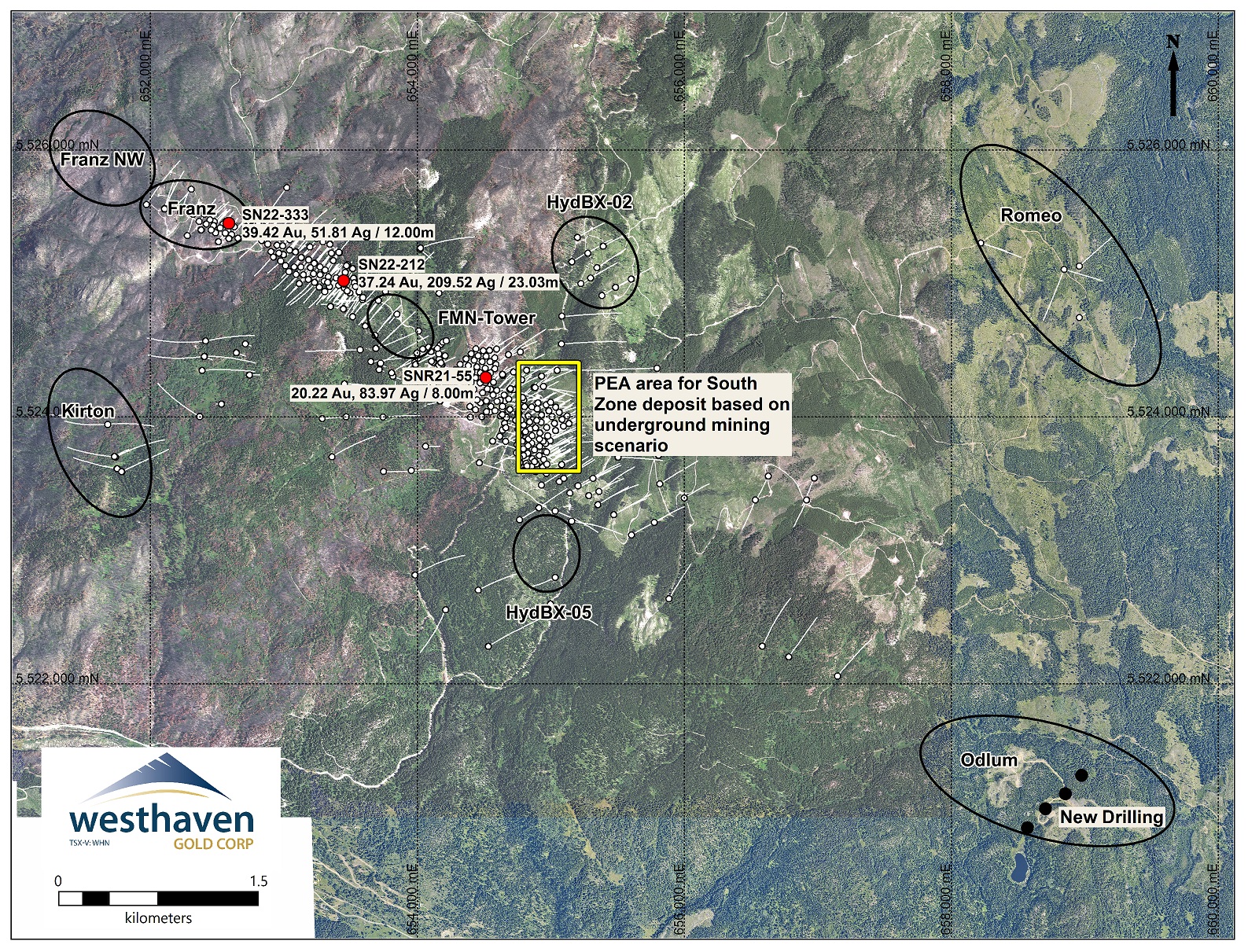

Gareth Thomas, President & CEO, comments: “Westhaven’s flagship Shovelnose Gold Property is located in close proximity to a highway and near the city of Merritt, BC in a tier 1 mining jurisdiction. This PEA focuses on the South Zone, discovered in late 2018 and with an initial Mineral Resource Estimate first reported in 2022. In addition to high grades, the South Zone benefits from wide, steeply dipping mineralized vein domains which contribute to a robust, low-cost (AISC US$752 / oz AuEq), high margin mining opportunity. Results from this PEA certainly underpin a significant property value with serious economic benefits and provide an excellent cornerstone from which to build upon. Westhaven’s continued focus is on exploration and expanding the gold-silver mineral inventory outside the South Zone. Multiple, notable discoveries have been made on this large (176 sq. km.) underexplored property since the initial South Zone discovery, all of which are outside the area assessed in the current PEA. With a fully funded drill program underway, management expects to be able to significantly increase the Property’s Mineral Resource base as we drill off the newer discoveries and test additional outside targets.”

Preliminary Economic Assessment Highlights:

*Base case parameters of US$1,800 per ounce gold, US$22 per ounce silver and CDN$/US$ exchange rate of $0.76.

*All costs are in Canadian dollars unless otherwise specified.

- Robust financial metrics.

- Pre-tax Internal Rate of Return (“IRR”) of 41.4%; After-tax IRR of 32.3%.

- Low All-In Sustaining Cost (“AISC”) of $989/ounce (“oz”) (US$752/oz) gold equivalent (“AuEq”).

- Low Cash Cost of $804 oz/AuEq (US$ 611/oz AuEq).

- Pre-tax Net Present Value (“NPV”6%) of $359 million (M) and After-tax NPV of $222M.

- Payback period from start of production year 1 of 2.4 years pre-tax and 2.6 years after-tax.

- After-tax (NPV 6%) increases to $268.4M and After-tax IRR increases to 37.2% using spot prices of US$1,950 gold and US$24 silver.

- Low capital-intensive development and operating costs.

- Total Preproduction Capital of $149.6M.

- Total Life of Mine (“LOM”) Capital Costs of $247M.

- Average operating cost of $132/ tonne processed.

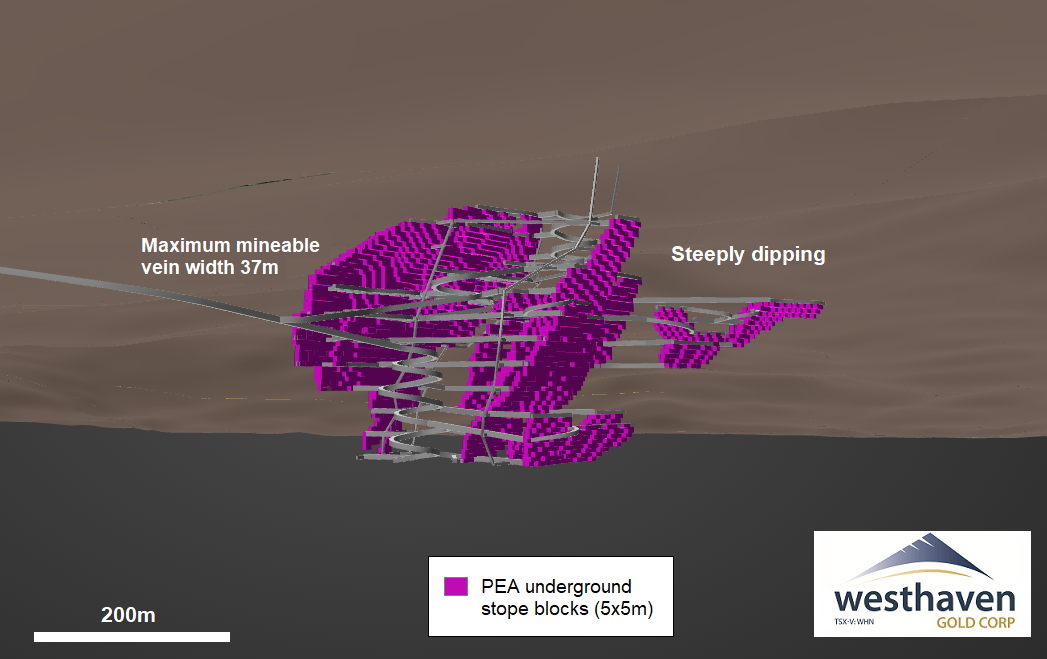

- 94% of total mining is cost effective longitudinal and traverse longhole stoping, with only 6% of total mining requiring cut and fill stoping.

- 9.5-year mine life and ability to expand processing to accommodate satellite discoveries.

- Production rate of 1,000 tonnes per day (“tpd”).

- Total payable metals of 534,000 oz gold (“Au”) and 2,715, 000 oz silver (“Ag”).

- Average annual production of 56,100 oz Au peaking in year 7 at 68,000 oz Au.

- Total mineralized rock production of 1,452,000 tonnes at 5.37 g/t Au and 28.62 g/t Ag.

- Metallurgical recoveries of 91.5% Au and 92.9% Ag.

- Community/stakeholder benefits.

- Total projected income taxes paid of $136M.

- Total projected British Columbia mineral taxes paid of $79M.

- More than 130 well-paying local full time jobs created during life of mine.

- Additional employment during construction phase.

- Indirect spin-off benefits during both construction and mine operations.

Mineral Resources, PEA Preparation and Results

The previous public Mineral Resource Estimate (“MRE”) for the South Zone was carried out by P&E Mining Consultants Inc. (“P&E”) with an effective date of January 1, 2022. That MRE was built with a pit constrained cut-off of 0.35 g/t AuEq and can be found at: 2022 News Release South Zone Pit Constrained MRE. The January 2022 MRE is superseded by the new July 2023 underground MRE reported herein. All drilling and assay data were provided by Westhaven, in the form of Excel data files. The GEOVIA GEMS™ V6.8.4 database compiled by P&E for the July 2023 MRE consisted of 162 surface drill holes, totalling 61,726 metres, of which 17 drill holes (SNR21-41 to 57), totalling 5,235 metres, were added to the initial January 2022 MRE. A total of 83 drill holes (32,089 metres) were intersected by the Mineral Resource wireframes used in the PEA.

P&E validated the Mineral Resource database in GEMS™ by checking for inconsistencies in analytical units, duplicate entries, interval, length or distance values less than or equal to zero, blank or zero-value assay results, out-of-sequence intervals, intervals or distances greater than the reported drill hole length, inappropriate collar locations, survey and missing interval and coordinate fields. Some minor errors were identified and corrected in the database. P&E are of the opinion that the supplied database is suitable for Mineral Resource estimation.

A block model was constructed using GEOVIA GEMS™ V6.8.4 modelling software and consists of separate model attributes for estimated Au, Ag and AuEq grade, rock type (mineralization domains), volume percent, bulk density, and classification. The Mineral Resource was classified as Indicated and Inferred based on the geological interpretation, variogram performance and drill hole spacing. P&E also considers mineralization at the South Zone to be potentially amenable to underground mining methods. The revised MRE used for the PEA is reported with an effective date of July 18, 2023, and is tabulated in Table 1.

| Table 1 | |||||||

| Shovelnose Underground Mineral Resource Estimate @ 1.5 g/t AuEq Cut-off (1-5) | |||||||

| Classification | Tonnes | Au | Contained Au | Ag | Contained Ag | AuEq | Contained AuEq |

| (k) | (g/t) | (k oz) | (g/t) | (k oz) | (g/t) | (k oz) | |

| Indicated | 2,983 | 6.38 | 612 | 34.1 | 3,273 | 6.81 | 654 |

| Inferred | 1,331 | 3.89 | 166 | 16.9 | 725 | 4.10 | 176 |

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

2. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

3. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

4. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5. PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be classified as Mineral Reserves, and there is no certainty that the PEA will be realized.

A financial model was developed to estimate the Life of Mine (“LOM”) plan and considered only underground mining of Mineral Resources at the South Zone. Other known gold-silver mineralization at the Shovelnose Gold Property, currently being evaluated by Westhaven, are not included.

The LOM plan covers an 11.5-year period (2 years pre-production and 9.5 years of production) Currency is in Q2 2023 Canadian dollars unless otherwise stated. Inflation has not been considered in the financial analysis.

The PEA outlines a production mine life of 9.5 years with average annual production of 56,100 ounces gold and 284,200 ounces silver at average cash costs and all-in sustaining costs ("AISC") per ounce gold equivalent of US$752. The PEA considers the payable recovery of 534,200 oz gold and 2,715,200 oz silver from an underground operation, at average mine production grades of 5.37 g/t and 28.62 g/t, respectively.

Revenue

The commercially saleable product generated by the Project is a gold/silver doré. Westhaven would be paid once the doré has been delivered to a smelter and refinery, off-site.

The NSR payables were based on the following parameters:

Dore Payable (Includes refining and smelting)

Au 98%

Ag 92%

The CDN$/US$ exchange rate used in the PEA is 0.76.

Subtotal Revenue

Au (US$) $961.5M

Ag (US$) $59.7M

Net revenue

CDN$ $1,343.7M

The revenue generation by the Shovelnose Project, on a yearly basis, is presented in Table 2.

| Table 2 | ||||||||||||

| Summary of Base Case Total Revenue Generation | ||||||||||||

| Item / Year | Yr -1 | Yr 1 | Yr 2 | Yr 3 | Yr 4 | Yr 5 | Yr 6 | Yr 7 | Yr 8 | Yr 9 | Yr 10 | Total |

| Tonnes | 10,771 | 343,150 | 365,250 | 365,250 | 365,250 | 365,250 | 365,250 | 365,250 | 365,250 | 365,250 | 176,509 | 3,452,430 |

| Grade (g/t) - Au | 8.01 | 5.61 | 5.51 | 5.12 | 5.73 | 5.61 | 6.46 | 4.89 | 5.2 | 4.84 | 3.84 | 5.37 |

| - Ag | 67.69 | 36.81 | 26.4 | 24.99 | 35.17 | 31.61 | 31.15 | 21.59 | 27.35 | 26.42 | 19.17 | 28.62 |

| Au Ounces Payable | 2,488 | 55,535 | 57,986 | 53,958 | 60,353 | 59,090 | 67,974 | 51,467 | 54,787 | 50,995 | 19,528 | 534,162 |

| Ag Ounces Payable | 20,035 | 347,099 | 264,961 | 250,841 | 353,003 | 317,271 | 312,635 | 216,716 | 274,479 | 265,193 | 92,997 | 2,715,231 |

| Subtotal Rev.-Au (US$)M | 4.5 | 100 | 104.4 | 97.1 | 108.6 | 106.4 | 122.4 | 92.6 | 98.6 | 91.8 | 35.2 | 961.5 |

| -Ag (US$)M | 0.4 | 7.6 | 5.8 | 5.5 | 7.8 | 7.0 | 6.9 | 4.8 | 6.0 | 5.8 | 2.0 | 59.7 |

| Subtotal Rev. (Cdn$) M | 6.5 | 141.6 | 145 | 135.1 | 153.2 | 149.1 | 170.0 | 128.2 | 137.7 | 128.5 | 48.9 | 1,343.7 |

| Net Royalty (Cdn$) M | 4.5 | 3.5 | 3.6 | 3.4 | 3.8 | 3.7 | 4.3 | 3.2 | 3.4 | 3.2 | 1.2 | 37.9 |

| Net Revenue (Cdn$) M | 2 | 138 | 141.4 | 131.7 | 149.3 | 145.4 | 165.8 | 125 | 134.3 | 125.2 | 47.7 | 1,305.8 |

Note Yr = Year

P&E has estimated the net revenues assuming Westhaven has taken advantage of available royalty buy-outs. There is a 2% Net Smelter Return (“NSR”) royalty on the Shovelnose Gold Property held by Franco-Nevada Corp. which Westhaven has the option to buy down to a 1.5% NSR for US$3M. There is a 2% NSR held by Osisko Gold Royalties Ltd. which Westhaven has the option to buy down to a 1% NSR for $500,000.

Costs

Operating costs:

Total average cost $132.15/t processed

Cash Cost / AuEq oz (Cdn$/oz AuEq) $804.19/oz AuEq (US$611.18/oz)

All-in sustaining cost (“AISC”)(Cdn$/oz AuEq) $989.12/oz AuEq (US$751.73/oz)

Capital costs:

LOM $247.0M

Sustaining CAPEX $104.9M

LOM capital costs include the cost of all mine development; process plant, mine equipment; surface infrastructure; underground infrastructure; a closure cost; a salvage credit; and a 20% contingency.

Stoping methods utilized are transverse longhole, longitudinal longhole and cut & fill. The average vein widths to be mined are 16.2m, 6.6m and 3.0m respectively.

Mining unit costs by method are $132.77/t for transverse and longitudinal long hole, and $143.87/t for cut & fill stoping.

The proportion of mining method during the life of mine is 62% longitudinal longhole, 32% for transverse longhole mining and 6% cut and fill.

| Table 3 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Base Case Cash Flow Summary | |||||||||||||||

| Item | Description / Year | Units | Yr - 2 | Yr - 1 | Yr 1 | Yr 2 | Yr 3 | Yr 4 | Yr 5 | Yr 6 | Yr 7 | Yr 8 | Yr 9 | Yr 10 | Total |

| Production | Mt | 0.01 | 0.34 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.18 | 3.45 | ||

| Au (g/t) | 8 | 5.6 | 5.5 | 5.1 | 5.7 | 5.6 | 6.5 | 4.9 | 5.2 | 4.8 | 3.8 | 5.4 | |||

| Ag (g/t) | 67.7 | 36.8 | 26.4 | 25 | 35.2 | 31.6 | 31.1 | 21.6 | 27.3 | 26.4 | 19.2 | 28.6 | |||

| Revenue | M$ | 2 | 138 | 141.4 | 131.7 | 149.3 | 145.4 | 165.8 | 125 | 134.3 | 125.2 | 47.7 | 1305.8 | ||

| OPEX | Stope Development (Ore) | M$ | 1.5 | 11.6 | 11.2 | 3.4 | 3.8 | 3.5 | 5.3 | 5.5 | 6.9 | 5.7 | 0.9 | 59.2 | |

| Longitudinal Longhole Stoping | M$ | 0.9 | 2.1 | 2.4 | 2 | 2.3 | 1.2 | 2.3 | 3.1 | 3.1 | 1.9 | 21.3 | |||

| Transverse

Longhole Stoping |

M$ | 1.8 | 1 | 1.4 | 1.5 | 1.5 | 2.3 | 1.3 | 0.3 | 11 | |||||

| Cut and Fill Stoping | M$ | 0.5 | 0.3 | 0.1 | 0.4 | 0.5 | 0.2 | 0.4 | 1.2 | 0.1 | 3.9 | ||||

| Mine G&A | M$ | 2.6 | 4.8 | 5.3 | 5.3 | 5.3 | 5.3 | 5.3 | 5.3 | 5.3 | 5.3 | 2.6 | 52.7 | ||

| Paste Backfill | M$ | 0.1 | 2.8 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 1.4 | 28.3 | ||

| Process Plant | M$ | 0.4 | 13.4 | 14.3 | 14.3 | 14.3 | 14.3 | 14.3 | 14.3 | 14.3 | 14.3 | 6.9 | 134.9 | ||

| Underground Haulage | M$ | 0.2 | 7.7 | 7.4 | 7.3 | 7.6 | 7.9 | 8.2 | 6.9 | 7.1 | 7.5 | 3.6 | 71.5 | ||

| Stockpile Rehandling | M$ | 0 | 0.9 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0.5 | 9.5 | ||

| Administration G&A | M$ | 4.6 | 6.1 | 6.1 | 6.1 | 6.1 | 6.1 | 6.1 | 6.1 | 6.1 | 6.1 | 4.1 | 64 | ||

| Total OPEX | M$ | 9.5 | 50.6 | 51.8 | 44.3 | 45.2 | 44.9 | 47.2 | 45.9 | 47.6 | 47.2 | 22.1 | 456.3 | ||

| CAPEX | Mine Development (Waste) | M$ | 18.2 | 21.6 | 11.9 | 2.1 | 2.5 | 3.8 | 4 | 1.4 | 5.6 | 2.6 | 73.8 | ||

| Process Plant | M$ | 44.6 | 22.3 | 3.3 | 3.3 | 3.3 | 3.3 | 80.2 | |||||||

| Mining Equipment | M$ | 8 | 12.2 | 1.9 | 0.2 | 1.6 | 1.7 | 7.6 | 1.5 | 4.6 | 1.4 | 40.7 | |||

| Underground Infrastructure | M$ | 0.4 | 2.2 | 1.1 | 1.3 | 0.2 | 1.3 | 0.8 | 1.3 | 0.2 | 0.2 | 0.2 | 9.1 | ||

| Surface Infrastructure | M$ | 45.1 | 0.2 | 2.3 | 0.4 | 1.6 | 3.5 | 0.6 | 53.6 | ||||||

| Closure & Salvage | M$ | 3.5 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | -17.1 | -10.5 | ||

| Total CAPEX | M$ | 44.6 | 97.5 | 36.6 | 20.9 | 4 | 8.4 | 8.7 | 19.6 | 4.5 | 14.6 | 3.2 | -15.6 | 247.0 | |

| Taxes | Income Tax | M$ | 5.9 | 17.2 | 20 | 19.6 | 24.4 | 14.9 | 17.2 | 15.2 | 2.9 | 137.3 | |||

| Mineral Tax | M$ | 1.8 | 1.9 | 1.8 | 12.4 | 12.4 | 13.4 | 10.1 | 9.8 | 10.2 | 5.5 | 79.3 | |||

| Total Taxes | M$ | 1.8 | 7.7 | 19.1 | 32.4 | 32.1 | 37.8 | 25 | 27 | 25.3 | 8.4 | 216.6 | |||

| After-Tax Cash Flow | M$ | -44.6 | -105 | 49 | 61 | 64.3 | 63.3 | 59.7 | 61.2 | 49.5 | 45.1 | 49.6 | 32.8 | 385.9 | |

| After-Tax Cumulative Cash Flow | M$ | -44.6 | -149.6 | -100.6 | -39.6 | 24.7 | 88 | 147.7 | 208.9 | 258.5 | 303.5 | 353.1 | 385.9 | ||

| After-tax IRR | % | 32.3% | |||||||||||||

| After-tax NPV @ 6% | M$ | 221.6 | |||||||||||||

Cash Flow Sensitivity Analysis

The following after-tax cash flow analysis was completed:

Net Present Value (“NPV”) (at 5%, 6%, 7%, 8%, 9% and 10% discount rates).

Internal Rate of Return (“IRR”).

Payback period.

The summary of the results of the cash flow sensitivity analysis is presented in Table 4.

| Table 4 Base Case Cash Flow Sensitivity Analysis |

|||

|---|---|---|---|

| Description | Discount Rate | Units | Value |

| Undiscounted After-Tax CF | 0% | (M$) | 385.9 |

| Internal Rate of Return | % | 32.3% | |

| After-Tax NPV at | 5% | (M$) | 243.1 |

| Base Case 6% | (M$) | 221.6 | |

| 7% | (M$) | 201.9 | |

| 8% | (M$) | 183.9 | |

| 9% | (M$) | 167.4 | |

| 10% | (M$) | 152.2 | |

| After-Tax Total Project Payback (including pre-production) | Years | 4.6 | |

The Project was evaluated on an after-tax cash flow basis which generates a net undiscounted cash flow estimated at $385.9M. This results in an after-tax IRR of 32.3% and an after-tax NPV of $221.6 M when using a 6% discount rate. In the base case scenario, the Project has a payback period of 4.6 years from the start of the Project. The average life-of-mine cash cost is Cdn$804.19/oz AuEq (US$611.18/oz AuEq), at an average operating cost of $132.15/t processed. The average life-of-mine all-in sustaining cost (“AISC”) is estimated at Cdn$989.12/oz AuEq (US$751.73/oz AuEq).

Sensitivity Analysis

Project risks can be identified in both economic and non-economic terms. Key economic risks were examined by running cash flow sensitivities to: gold metal price; silver metal price; gold process plant head grade; gold metallurgical recovery; operating costs; and capital costs.

Each of the sensitivity items were varied up and down by 10% and 20% to assess the effect they would have on the NPV at a 6% discount rate. The value of each parameter, at 80%, 90%, 100% base case, 110% and 120%, is presented in Table 5.

| Table 5 | |||||

| Sensitivity Parameter Values | |||||

| Parameter | 80% | 90% | 100% | 110% | 120% |

| Au Metal Price US$/oz | 1,440 | 1,620 | 1,800 | 1,980 | 2,160 |

| Ag Metal Price US$/oz | 17.6 | 19.8 | 22 | 24.2 | 26.4 |

| Au Head Grade g/t | 4.29 | 4.83 | 5.37 | 5.9 | 6.44 |

| Au Met Recovery % | N/A | 82.4% | 91.5% | N/A | N/A |

| Capex $M | 197.6 | 222.3 | 247 | 271.7 | 296.4 |

| Opex $M | 365 | 410.6 | 456.3 | 501.9 | 547.5 |

The resultant after-tax NPV @ 6% values of each of the sensitivity parameters at 80% to 120% are presented in Table 6.

| Table 6 | |||||

| After-Tax NPV Sensitivity to Base Case at 6% Discount Rate (M$) | |||||

| Parameter | 80% | 90% | 100% | 110% | 120% |

| Au Metal Price | 115.9 | 168.9 | 221.6 | 274.2 | 326.7 |

| Ag Metal Price | 215 | 218.3 | 221.6 | 224.9 | 228.2 |

| Au Head Grade | 115.9 | 168.9 | 221.6 | 274.2 | 326.7 |

| Au Met Recovery | N/A | 168.9 | 221.6 | N/A | N/A |

| Capex | 263.2 | 242.4 | 221.6 | 200.8 | 180.0 |

| Opex | 260.8 | 241.2 | 221.6 | 202.0 | 182.3 |

Cautionary Statement

The PEA is considered by P&E Mining Consultants Inc. (“P&E”) to meet the requirements as defined in Canadian National Instrument (“NI”) 43-101 Standards of Disclosure for Mineral Projects. This PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be classified as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no guarantee that Westhaven Gold Corporation will be successful in obtaining any or all of the requisite consents, permits or approvals, regulatory or otherwise for the Project to be placed into production. The PEA was prepared in accordance with the requirements of NI 43-101 and has an effective date of July 18, 2023. A technical report relating to the PEA, prepared in accordance with NI 43-101, will be filed on SEDAR and posted on the company’s website within 45 days of this news release.

On behalf of the Board of Directors

WESTHAVEN GOLD CORP.

"Gareth Thomas”

Gareth Thomas, President, CEO & Director

Qualified Person Statement

The Preliminary Economic Assessment for the Shovelnose Gold Property – South Zone was prepared by James L. Pearson, P.Eng., D. Grant Feasby, P.Eng., Yungang Wu, P.Geo., Antoine Yassa, P.Geo. and Eugene Puritch, P.Eng., FEC, CET of P&E Mining Consultants Inc., Brampton, Ontario, all Independent Qualified Persons as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The PEA results are based on important assumptions made by the Qualified Persons who prepared the PEA. These assumptions, and the justifications for them, will be described in the PEA Technical Report that the Company will file on SEDAR and post on the Company's website within 45 days of this news release. Mr. Puritch has reviewed and approved the technical contents of this news release.

Qualified Person Statement

Peter Fischl, PGeo, who is a qualified person within the context of National Instrument 43-101, has read and takes responsibility for this release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About Westhaven Gold Corp.

Westhaven is a gold-focused exploration company advancing the high-grade discovery on the Shovelnose project in Canada’s newest gold district, the Spences Bridge Gold Belt. Westhaven controls 37,000 hectares (370 square kilometres) with four 100% owned gold properties spread along this underexplored belt. The Shovelnose Property is situated off a major highway, near power, rail, large producing mines, and within commuting distance from the city of Merritt, which translates into low-cost exploration. Westhaven trades on the TSX Venture Exchange under the ticker symbol WHN. For further information, please call 604-681-5558 or visit Westhaven’s website at www.westhavengold.com.

Property Map Spences Bridge Gold Belt

Shovelnose gold property South Zone plan map

South Zone PEA Underground Stope Block Model