Westhaven Gold Corp.

1056 - 409 Granville Street

Vancouver, B.C. Canada V6C 1T2

info@westhavengold.com

Details

The 17,623 ha Shovelnose property is located near the southern end of the Spences Bridge Gold Belt (SBGB), approximately 30 km south of Merritt, British Columbia. The property is accessible by the Coquihalla Highway (BC Provincial Highway #5) at the Coldwater exit, then by a series of logging roads to the northern and southern portions of the property.

The Shovelnose claims cover prospective stratigraphy in the southern SBGB, a 110 km northwest–trending belt of intermediate to felsic volcanic rocks dominated by the Cretaceous Spences Bridge group. These relatively underexplored volcanic rocks are highly prospective for epithermal style gold mineralization. Low-sulphidation epithermal gold quartz veins occur throughout the range of Spences Bridge Group stratigraphy. Westhaven has a 100% interest in this property subject to a 4% NSR. Westhaven has the option to purchase 1% of the 4% NSR back for C$500,000 up to commercial production and an additional 0.5% for US$3,000,00 for a period of 5 years (commencing Oct 6th, 2022).

Westhaven has drilled approximately 465 holes in just over 161,597 metres of diamond drilling since the companies inception in 2011 and approximately $40 million dollars has been spent on exploration and drilling at the Shovelnose Gold Property.

WESTHAVEN ANNOUNCES ROBUST PRELIMINARY ECONOMIC ASSESSMENT OF THE SOUTH ZONE, SHOVELNOSE GOLD PROJECT, BRITISH COLUMBIA

July 18th, 2023 – Westhaven announced the completion of a Preliminary Economic Assessment at its 100% owned 17,623-hectare Shovelnose Gold Property.

Preliminary Economic Assessment Highlights:

*Base case parameters of US$1,800 per ounce gold, US$22 per ounce silver and CDN$/US$ exchange rate of $0.76.

*All costs are in Canadian dollars unless otherwise specified.

- Robust financial metrics.

- Pre-tax Internal Rate of Return (“IRR”) of 41.4%; After-tax IRR of 32.3%.

- Low All-In Sustaining Cost (“AISC”) of $989/ounce (“oz”) (US$752/oz) gold equivalent (“AuEq”).

- Low Cash Cost of $804 oz/AuEq (US$ 611/oz AuEq).

- Pre-tax Net Present Value (“NPV”6%) of $359 million (M) and After-tax NPV of $222M.

- Payback period from start of production year 1 of 2.4 years pre-tax and 2.6 years after-tax.

- After-tax (NPV 6%) increases to $268.4M and After-tax IRR increases to 37.2% using spot prices of US$1,950 gold and US$24 silver.

- Low capital-intensive development and operating costs.

- Total Preproduction Capital of $149.6M.

- Total Life of Mine (“LOM”) Capital Costs of $247M.

- Average operating cost of $132/ tonne processed.

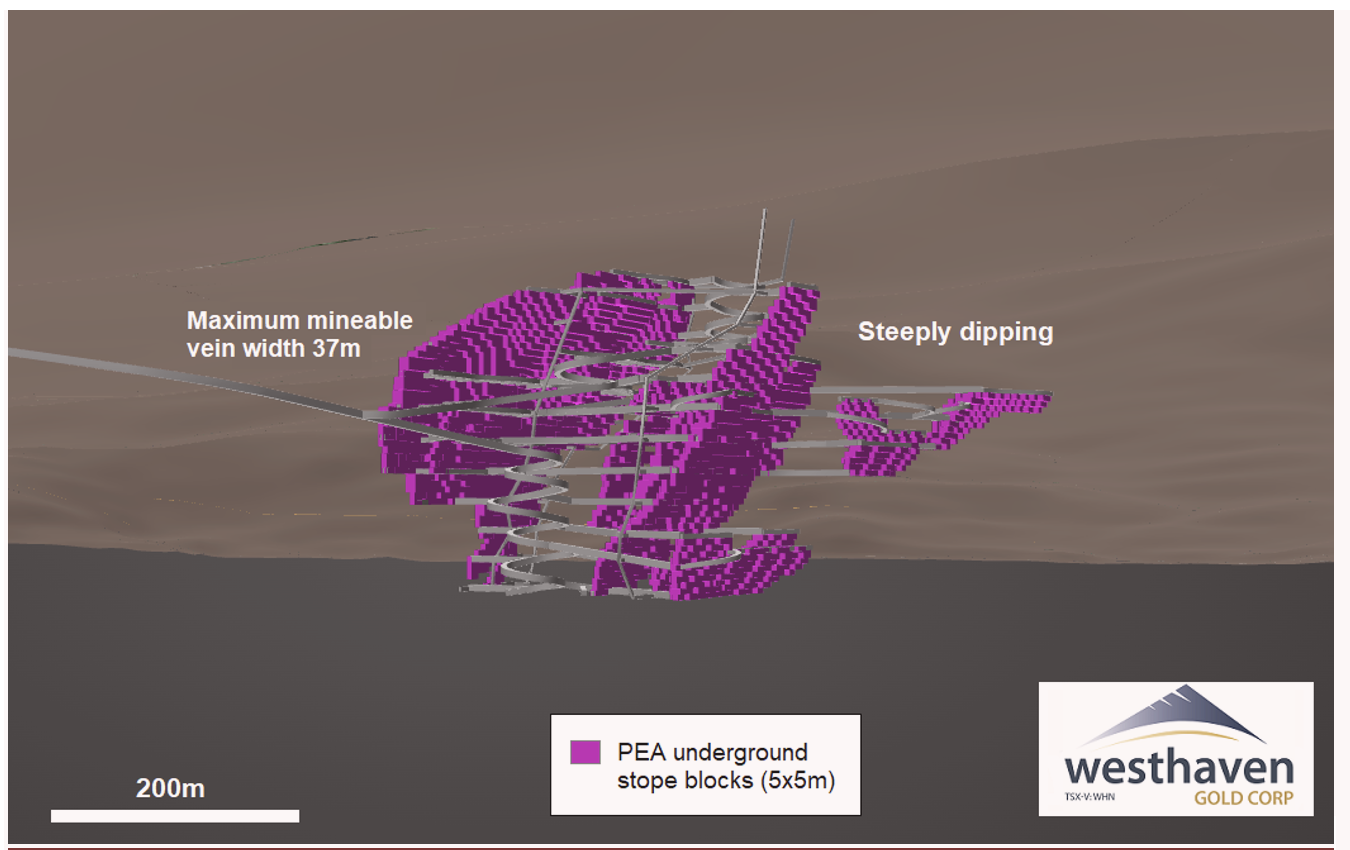

- 94% of total mining is cost effective longitudinal and traverse longhole stoping, with only 6% of total mining requiring cut and fill stoping.

- 9.5-year mine life and ability to expand processing to accommodate satellite discoveries.

- Production rate of 1,000 tonnes per day (“tpd”).

- Total payable metals of 534,000 oz gold (“Au”) and 2,715, 000 oz silver (“Ag”).

- Average annual production of 56,100 oz Au peaking in year 7 at 68,000 oz Au.

- Total mineralized rock production of 1,452,000 tonnes at 5.37 g/t Au and 28.62 g/t Ag.

- Metallurgical recoveries of 91.5% Au and 92.9% Ag.

- Community/stakeholder benefits.

- Total projected income taxes paid of $136M.

- Total projected British Columbia mineral taxes paid of $79M.

- More than 130 well-paying local full time jobs created during life of mine.

- Additional employment during construction phase.

- Indirect spin-off benefits during both construction and mine operations.

South Zone PEA Underground Stope Block Model

Mineral Resources, PEA Preparation and Results

The previous public Mineral Resource Estimate (“MRE”) for the South Zone was carried out by P&E Mining Consultants Inc. (“P&E”) with an effective date of January 1, 2022. That MRE was built with a pit constrained cut-off of 0.35 g/t AuEq and can be found at: 2022 News Release South Zone Pit Constrained MRE. The January 2022 MRE is superseded by the new July 2023 underground MRE reported herein. All drilling and assay data were provided by Westhaven, in the form of Excel data files. The GEOVIA GEMS™ V6.8.4 database compiled by P&E for the July 2023 MRE consisted of 162 surface drill holes, totalling 61,726 metres, of which 17 drill holes (SNR21-41 to 57), totalling 5,235 metres, were added to the initial January 2022 MRE. A total of 83 drill holes (32,089 metres) were intersected by the Mineral Resource wireframes used in the PEA.

The revised MRE used for the PEA is reported with an effective date of July 18, 2023, and is tabulated in Table 1.

| Table 1 | |||||||

| Shovelnose Underground Mineral Resource Estimate @ 1.5 g/t AuEq Cut-off (1-5) | |||||||

| Classification | Tonnes | Au | Contained Au | Ag | Contained Ag | AuEq | Contained AuEq |

| (k) | (g/t) | (k oz) | (g/t) | (k oz) | (g/t) | (k oz) | |

| Indicated | 2,983 | 6.38 | 612 | 34.1 | 3,273 | 6.81 | 654 |

| Inferred | 1,331 | 3.89 | 166 | 16.9 | 725 | 4.10 | 176 |

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

2. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

3. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

4. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5. PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be classified as Mineral Reserves, and there is no certainty that the PEA will be realized.

PREVIOUS INITIAL MINERAL RESOURCE ESTIMATE

In January 2022, the company announced the results from its Mineral Resource Estimate (MRE) at its 100% owned 17,623-hectare Shovelnose Gold Property. The initial open-pit constrained MRE reported below (Table 1) is of the South Zone, and was completed by P&E Mining Consultants Inc., based on a total of 145 surface drill holes (56,491 m), 25,920 drill core analyses, 3,302 bulk density measurements, and preliminary metallurgical testwork.

Please see Initial Mineral Resource Estimate News Release dated: January 10th, 2022 here: https://www.westhavengold.com/news-and-media/news/news-display/index.php?content_id=299

Shovelnose South Zone MRE Highlights:

- 791,000 ounces of gold and 3,894,000 ounces of silver Indicated.

- 263,000 ounces of gold and 1,023,000 ounces of silver Inferred.

- 75% of the MRE in the higher confidence Indicated classification: 10.60 million tonnes at 2.47 g/t for 841,000 gold equivalent (AuEq) ounces.

- Average AuEq grade of Indicated MRE is 7 times higher than the cut-off grade, demonstrating excellent potential for future economic extraction (Table 2).

- Indicated mineralization is largely associated with the individual vein zones, whereas the Inferred is associated with the broader Veinlet Domain (please see Figure 1).

- This MRE is based on potential open-pit extraction – an MRE based on potential underground mining is in preparation and will be reported in the coming months.

- South Zone is just one of the many known mineralized zones on the Shovelnose Gold Property.

- Shovelnose is situated off a major highway, near grid power, rail, large producing mines, and within easy commuting distance from the City of Merritt.

Westhaven drilled 38,147m at Shovelnose in 2022.

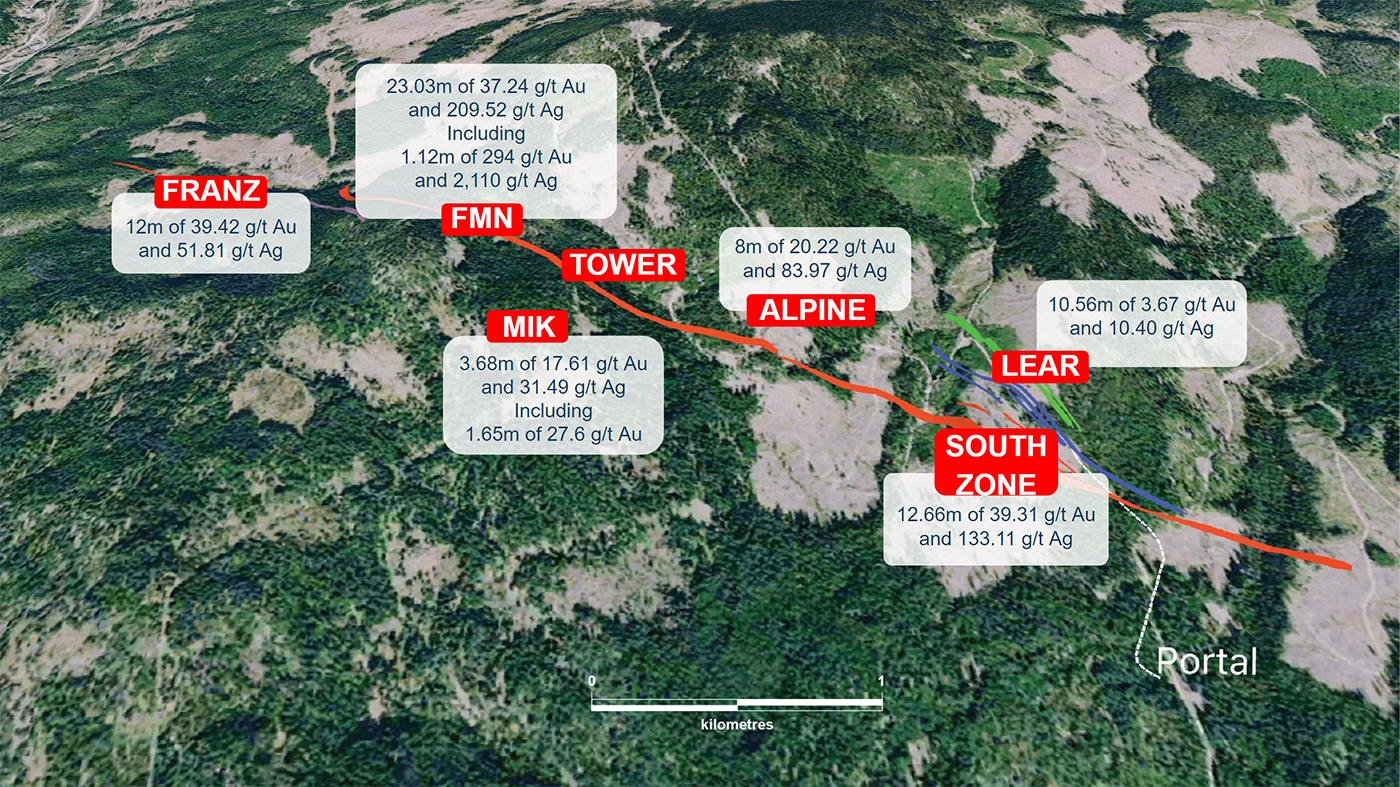

On April 6, 2022, the company announced the highest grade gold-silver intercept ever drilled on the Shovelnose Gold property (please see news release here: https://www.westhavengold.com/news-and-media/news/news-display/index.php?content_id=306) 23.03 metres of 37.24 g/t gold and 209.52 g/t silver.

SHOVELNOSE gold PROPERTY (drilling highlights)

Westhaven will be focusing the majority of its 2023 drill budget on newly generated targets outside of the ~4km long Zone One Trend, host to mineralization previously identified at the South Zone, Alpine, Tower, FMN and Franz zones. Additional drilling is also needed in a gap between Tower and FMN.

Shovelnose discovery history:

In late 2017, Westhaven discovered a significant gold-bearing vein system, the South Zone. In 2018, we completed 22 holes for a total 8,613 metres of diamond drilling. In 2019, 49 holes for 21,849 metres was drilled.

Significant Drill Intercepts from 2018 to 2022

-

SN18-12: 1.65m of 175.00 g/t Au and 249.00 g/t Ag

-

SN18-14: 17.70m of 24.50 g/t Au and 107.92 g/t Ag

-

SN18-15: 46.90m of 8.95 g/t Au and 65.47 g/t Ag

-

SN19-01: 12.66m of 39.31 g/t Au and 133.11 g/t Ag

-

SN19-10: 18.50m of 11.39 g/t Au and 40.21 g/t Ag (Vein Zone 2)

-

SN19-11: 1.00m of 557.00 g/t Au and 381.00 g/t Ag

-

SN19-15: 7.11m of 9.42 g/t Au and 69.36 g/t Ag (Vein Zone 3)

-

SN20-101: New Discovery (Franz Zone) 7.78m of 14.84 g/t Au and 39.40 g/t Ag. at surface

-

SN21-161: New Discovery (FMN Zone) 15.97m of 9.15 g/t Au and 27.43 g/t Ag

-

SN22-212: (FMN Zone) 23.03m of 37.24 g/t Au and 209.52 g/t Ag

-

SN22-211: (FMN Zone) 36m of 3.74 g/t Au and 20.49 g/t Ag

-

SN22-229: (FMN Zone) 14.96m of 5.69 g/t Au and 343.57 g/t Ag

- SN22-333: (Franz Outcrop) 12m of 39.42 g/t Au including 6.2m of 73.51 g/t Au

Picture of the Franz Outcrop looking northwest

Discovery Hole SN18-14: Zone of quartz-adularia veining assaying 24.5 g/t Au, 107.9 g/t Ag over 17.77m. Strongly banded interval in bottom core box returned 50.8 g/t Au and 203.5 g/t Ag over 6.78m (218.0-224.78m).

History

Between the 19th and 20th centuries the discovery of placer gold 75 km to the northwest of Shovelnose ignited the Fraser and Thompson Rivers gold rush (Balon, 2005). Placer gold was mined from gravel bars on major tributaries in the Ashcroft-Lytton-Lillooet district. In particular, the Nicoamen River, located 23 km northwest from Shovelnose Mountain, played a role in initiating the gold rush in the Merritt region.

In 2011, Westhaven Gold Corp. acquired an option on the Shovelnose gold property from Strongbow Exploration Inc. In the same year Westhaven completed a program including soil (972) sampling, stream silt (28) sampling, rock grab (107) and rock chip (91) sampling, mechanical trenching (146.5 m), and diamond drilling 606m in 7 holes). Drilling tested the Mik (3 holes), Line 6 (3 holes) and Tower (1 hole) showings.

In 2012 Westhaven completed 5.8 line-kilometres (3 lines) of reconnaissance-scaled Induced Polarization and ground magnetic geophysical surveys in the vicinity of the Tower, Mik, and Line 6 showings. Follow-up diamond drilling consisted of 5 holes totaling 778.5 metres. The 2012 drill program tested the Tower zone (holes SN-12-02, 03, and 04), intersecting a zone of intensely silicified, limonite stained rhyolite tuff with pyritized grey chalcedonic quartz flooding. Gold mineralization was encountered in all five drill holes, however, the Tower zone appears to host the largest consistent near surface gold mineralization discovered on the Property to date.

Hole SN-12-04 intersected 106.5 m of very highly silicified breccias with original lithologies and textures mostly obliterated due to the intense silica flooding. Within the 106.5 m long zone of silicification a 53.5 m long zone containing dark grey to black pyritiferous breccia matrix accounted for most of the gold mineralization grading 0.51 g/t Au; 4.6 g/t Ag.

In 2013 Westhaven completed programs consisting of prospecting, geophysical Induced Polarization and ground magnetic geophysical surveys (3.75 line-km on 5 lines) and diamond drilling (8 holes totaling 1,043.0 metres) in the Tower zone area. The main focus of the 2013 drill program was to test extensions of mineralization at the Tower zone.

In 2014 Westhaven completed 6 diamond drill holes totaling 662.5 metres. The drill program was designed to test for extensions and the potential for a possible feeder zone bearing higher grading gold mineralization below or along strike to SN-12-04. One hole was drilled in the MIK showing to possibly undercut gold mineralization discovered during the 2011 drill program.

In 2015 Westhaven completed an airborne Light Detection and Ranging Survey (LIDAR) over an area of 19.5 km2, Induced Polarization (12.75 line-kilometres), VLF-EM (54.94 linekilometres),and ground magnetic (23.45 line-kilometres) geophysical surveys. The most significant discovery was the Alpine showing, a northwesterly trending, moderate intensity resistivity anomaly coincident with a moderate intensity chargeability anomaly, located approximately 450 metres east of the Tower zone that has been defined over a strike length of 1 kilometre. Follow-up diamond drilling consisting of 5 holes totaling 1,408 metres drilled in the Line 6 (2 holes), Tower (2 holes), and Alpine (1 hole) zones.

In 2016 Westhaven completed 9 diamond drilling holes totaling 1,902 metres. Three holes were drilled into the Tower zone in an attempt to ascertain the geometry of possible feeder zones to the upper lower-grading gold mineralized tuffs and six holes tested the Alpine Zone IP chargeability anomaly.

In 2017 a ground magnetics survey was completed over the Tower and Alpine Zones. A northeast trending linear magnetic low was noted truncating the southern extent of the chargeability anomaly.

Drillholes 17-06 and 17-07 targeted the linear magnetic anomaly (Figure 6). Drillhole 17-06 (Az 110°, Dip -50°) was collared 210 metres southwest of drillhole SN16-02. Drilling intersected an upper unit of silicified rhyolite tuff to 266 metres depth, underlain by heterolithic, welded, and rhyolite tuffs to 447 metres depth which were underlain by andesites and basalts to 506 metres depth. Although west dipping quartz veining was noted from bedrock surface to 477 metres depth, gold mineralization was most prominent within the upper rhyolite tuffs averaging 0.52 g/t Au and 1.4 g/t Ag over 85.0 metres (Figure 11). Within this zone higher grading intervals include 1.02 g/t Au and 2.5 g/t Ag over 17.0 metres.

Drillhole 17-07 (Az 110°, Dip -50°) was collared 120 metres northeast of 17-06. Drilling intersected silicified rhyolite tuffs from bedrock surface to 293 metres depth, underlain by heterolithic tuffs to the end of the hole at 431 metres depth (Figure 12). Numerous steeply dipping basalt dykes were intersected near the bottoms of both 17-06 and 17-07. Similar to 17-06, west dipping quartz veining was noted throughout the hole and gold mineralization was most prominent within the near surface silicified rhyolite tuffs averaging 0.29 g/t Au and 1.1 g/t Ag over 101.0 metres. Within this area higher grading zones include 2.48 g/t Au and 5.4 g/t Ag over 5.7 metres.